30+ How much mortgage could we get

A year ago the benchmark 30-year fixed-rate mortgage was 303 percent. Private mortgage insurance PMI.

Money Saving Challenge Printable Save 1000 In 30 Days Etsy Saving Money Chart 52 Week Money Saving Challenge Saving Money Budget

Speak to an expert broker.

. Founded in 1976 Bankrate has a long track record of helping people make smart financial choices. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month the less you can borrow. Using our Mortgage Calculator can take.

If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances. A 30-year mortgage generally offers lower monthly payments. Weve maintained this reputation for over four decades by demystifying the financial decision.

Alternatively if you dont have your mortgage account number to hand get an idea of what mortgages we could offer you and how much the monthly costs would be by answering a few questions. You can learn more about the standards we follow in producing accurate. Four weeks ago the rate was 563 percent.

And with economists predicting a wave of foreclosures in 2021 there. With a 15-year mortgage youd have a higher. Too much could deplete your savings or negatively affect your long-term financial health.

See todays 30-year mortgage rates. For today Friday September 16 2022 the current average rate for the benchmark 30-year fixed mortgage is 628 up 17 basis points over the last seven. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for.

This calculator provides useful. The Best 30-Year Mortgage. A 15-year loan does come with a higher monthly payment so you may need to adjust your home-buying budget to get your mortgage payment down to 25 or less of your monthly income.

Mortgage rates remain historically low and rental income could offer valuable protection against ongoing economic uncertainty. Weve broken down some bullets of things to consider when deciding whether to pay off your mortgage early. How much money has the average 30-year-old saved.

The 30-year average has risen by more than a full percentage. If your down payment is less than 20 of the home purchase price your conventional mortgage lender may require you to buy private mortgage insurance a type. 2022 Best Mortgage Companies To Work For.

Find and compare 30-year mortgage rates and choose your preferred lender. This means youll be able to pay the loan off faster and pay less interest over the life of the loan. We receive a commission from.

For a 250000 loan that could mean a difference of more than 100000. Get Started Ask Us A Question. Borrowers benefit from the 30-year by getting steady affordable monthly mortgage payments with no surprises.

Do you want to. Check Out Our Free Newsletters. You could access 30 more of the mortgage market with a broker on your side.

News analysis and perspective from National Mortgage News an award-winning comprehensive digital resource serving the entire residential mortgage industry. Founded in 1976 Bankrate has a long track record of helping people make smart financial choices. Home buying with a 70K salary.

In this post weve tracked rates for 30-year fixed-rate mortgages. What this means. The average mortgage interest rate is around 55 for a 30-year fixed mortgage.

Todays national mortgage rate trends. Includes fixed 30-year mortgage rates for FHA VA and conventional loans plus advice to find your best rate. Rates for a 30-year mortgage refinance fell slightly today giving homeowners who want a longer repayment term an opportunity to save on interestMeanwhile rates for 20-year.

Youre way ahead of your peers. Its much more complex. With this option the total amount you pay over the life of the loan will usually be higher.

We calculate this based on a simple income multiple but in reality its much more complex. Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher.

Check rates today to learn more about the latest 30-year mortgage rates. Weve maintained this reputation for over four decades by demystifying the financial decision. Because youll pay thousands more in interest if you go with a 30-year mortgage.

This formula can help you crunch the numbers to see how much house you can afford. But 15-year fixed-rate mortgages tend to have even lower borrowing rates. A loan of 30 years is a particularly good choice for homebuyers who think they may settle in their houses for a while.

The earlier into the loan you do this the more of an impact it will have. The 30-year fixed mortgage is the most popular type of home loan. In a typical 30-year mortgage about half the total interest you pay will accumulate in the first 10 years of your loan.

Every day get fresh ideas on how to save and make money and achieve your financial goals. Were celebrating their accomplishments in 2021. If you actually have 47000 saved at age 30 congratulations.

We guarantee to get your mortgage approved where others cant - or well give you 100 Get Started Find Out More. The 30-year fixed-rate average for this week is 309 percentage points higher. Mortgage rates valid as of 31 Aug 2022 0919 am.

Find out how much you could borrow for a mortgage compare rates and calculate monthly costs using our mortgage calculator. For example a 30-year fixed mortgage would have 360 payments 30x12360. Rates are influenced by the economy your credit score and loan type.

Speak to a mortgage affordability specialist. Generally a 15-year mortgage means higher monthly payments.

Airbnb Superhost Bundle Etsy Airbnb Decorate Airbnb Airbnb House

Do You Think All Homeowners Must Have A 20 Down Payment To Purchase A Home Luckily Mortgage Brokers Have S Real Estate Tips Back To Basics Home Ownership

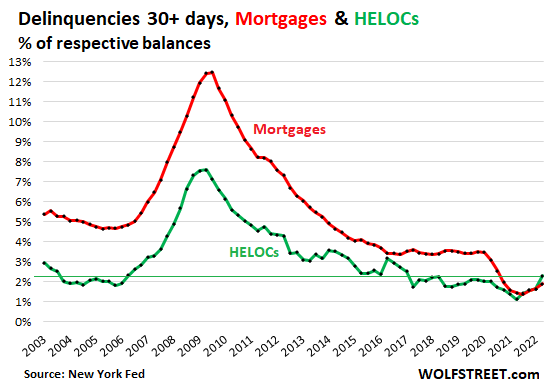

Trip Back To Reality Starts Q2 Mortgages Helocs Delinquencies And Foreclosures Seeking Alpha

How Federal Tapering Effects The Housing Market Economy Infographic Mortgage Interest Rates Mortgage Payoff

Quintessential Mortgage Group On Instagram Gina Ferri Has Been A Certified Public Accountant For Over 25 Ye Certified Public Accountant Loan Officer Mortgage

30 Maps Of America That Will Make You Question Everything You Know About The Usa Opossumsauce America Map Usa Map Question Everything

Pin On Personal Finance Tips

What To Do If You Can T Pay Your Mortgage Budgeting Money Saving Money Challenge Biweekly Money Tips

Clear To Close Mortgage Loan Officer Mortgage Shirt Lender Shirt Mortgage Lender Gift Loan Officer Gift In 2022 Realtor Shirt Mortgage Loan Officer Loan Officer

30 Splendid Beach House Decor Ideas You Should Copy Beach House Living Room Beach House Interior Summer Living Room Decor

Dave Ramsey S 7 Baby Steps What Are They And Will They Work For You Money Management Money Saving Strategies Money Management Advice

Mortgage Broker Facebook Ads Case Study 131 New Consultations Mortgage Brokers Case Study Finance Goals

Pin On Business

Fifteen 52 Week Money Saving Challenges Something For Every Budget 52 Week Money Saving Challenge Money Saving Challenge Saving Money Budget

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

Scripts To 30 Loan Documents For Loan Signing Agents Etsy Loan Signing Loan Signing Agent Notary Signing Agent

5 Tips To Save A Lot Of Money Fast 1 000 In A Month Challenge Saving Money Chart Saving Money Budget Money Saving Strategies